How Startup Funding Rounds Work

We often get asked about the main funding rounds are for startups and how they differentiate from each other. So we decided to make a brief summary, following an exciting session with Alejandro Cremades.

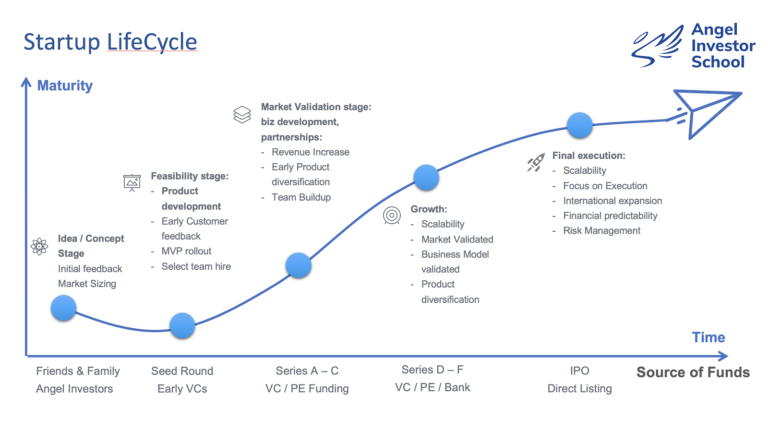

To start, startups are born and grow through different funding means. Some may never experience the need for external funding, as their revenues are enough to sustain and grow the business. However, this is not the most common path for startups as they usually need funding in different amounts and at different points of time, especially the most ambitious startups. These periods of funding are known as “rounds”.

Initial words and points to note

Entrepreneurs and investors have different expectations at each stage, so it is important to know where angels fit. It is also important to know what your individual angel and risk profile is, as being an angel doesn’t necessarily mean you should be investing in a particular round. The better you know yourself, the easier it will be to aim at a specific group of startups fundraising in the rounds that best suit you.

It is difficult to estimate the timings for each round, as they may differ substantially. However, a good estimate would indicate that each round will typically happen every 12 to 18 months. Bear in mind, that for the individual entrepreneur, the close of one funding round leads to the opening of the next, all the way until the company is acquired or goes public. Your funding as an angel will allow the startup to survive, and thrive, until the next round.

Also, please note that at any given time the startup may be acquired by a bigger or more established company. This is not usually considered a funding round, but may present an exit opportunity for angels and investors, depending on whether the company is worth something or worthless (but there is a company willing to save the product and the employees from closure). Unfortunately in this latter case, there isn’t much you can do with your shares, as the deals usually wipe angels out and the startup ceases to exist.

Founders’ capital or “bootstrapping”

Usually startups start with the founders’ own capital. This is known as “bootstrapping”. This is usually a short term solution (unless the founders’ have successfully exited other businesses) as the startup will need much more capital as they grow and evolve. Usually founders contribute initially with around $10,000, but this can be as low as $1,000 or as high as $200,000. There is no guideline really, but the objective is get the wheels going and build a credible plan.

If they are lucky enough, they will be generating revenues with this little capital and the longer they can stay afloat, the more valuable their company should be. This would also imply that there is more data for you to take a decision as an angel, but the valuation should move higher as well.

Sooner or later, founders will (most likely) need external money to either grow the business, expand into new products or regions, or simply perfect their product.

Pre-Seed Funding

Pre-seed funding is possibly the first round after the founders have run out of money (or decided that they didn’t want to take any more risk with their own capital). The goals of pre-seed funding are essentially to develop the concept (product or service), perform preliminary market research and product viability, develop their pitch, get their mission and vision aligned, and create or develop a minimum viable product (MVP).

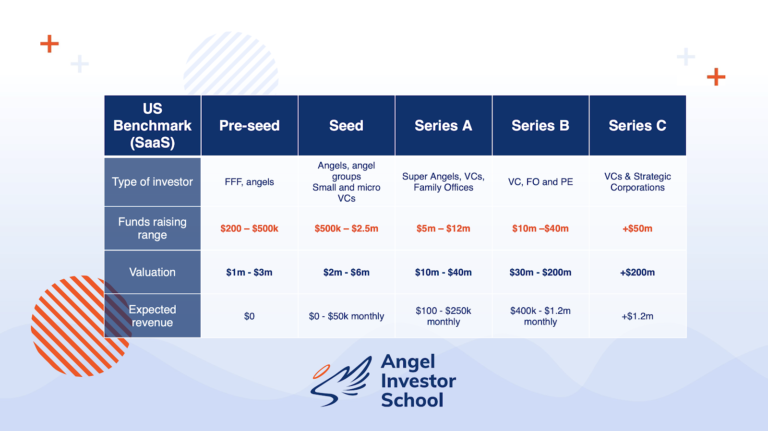

Institutional and professional capital from venture capital firms is usually scarce at this point. The main participants of pre-seed funding will therefore be friends and families from the founders, as well as angel investors. These may provide anywhere from $10,000 to over $500,000 in early funding. In certain jurisdictions like the UK, there are strong government incentives at this stage which are designed for investors to reduce their risk.

Don’t expect the startup to have much in terms of revenue, but do check the valuations (if they have them) carefully, especially when it comes to assumptions and where they think they will spend your cash.

Pre-seed stage will provide the lowest valuations for any startup and hence increase the equity you receive for your money. At the same time, risk is at it highest since there are too many uncertainties.

Anyone investing in the pre-seed stage must love the founders and potentially the idea.

Seed Stage Funding

Goals: Product or service, extensive market research, market and demographics, founding team in place with clear roles, hiring, increase marketing

Seed stage is where funding rounds become more formal. Although the startup is still at the idea stage (with potential revenues), founders find themselves trying to convince investors (and clients) that their idea or product is worth what they say it is. Startup accelerators will get involved at this stage and provide tools and some cash, but most importantly a badge or seal of approval which will be of great value as investors get some assurance of the quality of the founders.

Angel investors will also be key at this stage, especially those who usually wait for the idea or products to be slightly more developed (and less of a gamble) than in the pre-seed stage. As a new angel, seed stage will usually provide a lower degree of risk than pre-seed (and an increased valuation too). But it is still a very high risk for any investor. You will also see smaller and micro VC companies and the odd large VC looking to get their foot in the door in order to have preference rights in further rounds, should the startup make it.

Main goals for the funds at this stage are extending the market research, demographics, putting a team in place with clear roles, hiring, increasing marketing, and developing the product or the MVP.

Pre-Series A Round (a.k.a. Bridge Round)

Bridge financing usually takes the form of a loan which may be provided by banks, other institutions, or the current investors in a startup. Basically, this type of funding usually does not imply granting equity (and therefore some people don’t consider it as a funding round), but offers instead an interest payment. As its name suggests, the loan will help the founders arrive from their current point to the next funding round. Hence the word “bridge”.

This will help founders either solidify their short-term position until a long-term financing option can be arranged. Founders may need the cash to reach certain milestones (revenue, sales, growth, development) before launching the next funding round (and hence increase the startup’s value).

The other typical reason why founders will use bridge rounds is to “survive” a current temporary or unexpected problem or situation, which should not affect the fundamental value of the startup. This may help the startup and avoid it from going out of business, something none of its investors would probably want (and therefore they are the most likely institutions or people to provide the bridges).

Series A Round

If a startup has reached Series A, it means that the funding has been well deployed and that the startup is gaining traction and sales. The solution the startup brings to the market has had good acceptance and is now time to expand, open up distribution channels, add new market developments, add visibility and complete any products currently under construction. The data also shows good response, and founders are acting based on it.

It is expected that a US startup reaching Series A rounds is now at or close to breakeven, and that monthly revenues may be in the $100k to $250k.

Series A typically will find VCs, family offices, angel groups and clubs, and super angels as their typical investors.

Series B Rounds

They say B is for Building out. After a solid performance and great traction, now is the time to really scale the business and expand it, potentially cross-border. Statistics show that approximately just half of all startups make it to raise a Series B. Scale of operations, international expansion, aggressive advertisement, and aggressive hiring will be just some of the uses of the money raised in Series B.

The valuations will be in the tens of millions of dollars and typically you will see PE firms as well as larger family offices and VCs coming to the party. Revenues should be significant at approximately $500k to $1m per month.

If you have invested as an angel in a company that reaches Series B funding, it may be a good option to either exit or think about increasing your exposure to avoid/reduce dilution (although this may not be feasible for many angels in terms of cash available). However, dilution does not necessarily mean a bad thing, since it is likely that the valuation of the company has increased exponentially since your investment came in.

To the moon! Series C+

If a startup manages to reach Series C or beyond, it means it’s doing quite well and it is now time for the big funding rounds. At this point, angels will have probably been diluted significantly (sit tight for a note dilution and follow-on investments), but this is not a problem. Startups usually use Series C rounds for scaling their businesses, either via different products or services, or expanding the business overseas.

As an angel, you will likely have no (or little) say in the company at this point, as major investors (VCs, banks, PE firms, strategic corporations) are going to be leading the negotiations and pushing founders to where they believe the company should go. Our recommendation, should a company you have invested in reaches this point, is sit back and enjoy. You may also try to learn from the big investors as well as try to network with them. They have been in the business for a long time, so learning from them will be of great value to you. From how they perform due diligence to how they negotiate with founders and current investors.

The startup is now probably worth in excess of $100m, and the new money will take it very close to becoming public. Good job if your investment made it!

Going Public

The final liquidity event will typically mean the exit for any remaining angel investors, although some may wish to keep your shares in many cases (please see our full interview with Zoom’s first angel investor, Dan Scheinman). We are talking about the hope for the company (or now Unicorn) to go public.

In the last few years, we have seen that many tech companies choose a direct listing over an IPO. The main difference between them is that the IPOs will generally have a fully underwritten issuance of shares (and vesting period for employees and shareholders), while direct listings use no intermediaries and have no guarantees on placement and allow everyone to sell their shares directly at any time. The message sent by a company offering a direct listing is strong, as it gives their shareholders the freedom to sell, meaning that the company believes in its strength and doesn’t need to keep people at bay. This usually implies much lower bankers fees.

Moreover, direct listings usually avoid many of the steps of traditional IPOs, such as setting an initial price, going on extensive roadshows, and engaging many investment banks. Direct listings are usually done by well-known brands which can afford to self-market and gain interest on their shares.

In any of these cases, your shares will become liquid to trade in the open market and, provided you have invested early, you should be able to realize a good profit.

Final words

Although valuations, funding amounts, reasons and goals, as well as interested investors may shift depending on the country or region and other external factors, we believe this is an accurate description of the main funding rounds and where it may be best (or most common) for angels to come in. We hope you have enjoyed this short summary on the different kinds of funding rounds. Stay tuned for the next one!